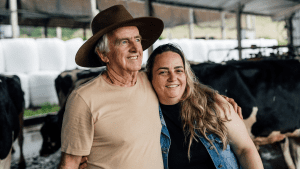

What to Do When You and Your Family Can’t Agree on Succession Planning

Succession planning sounds simple… until your family can’t agree. When emotions, expectations, and unspoken history get in the way, even the best intentions can lead to tension or silence. This blog explores why family succession discussions are so hard and how to move forward without conflict.