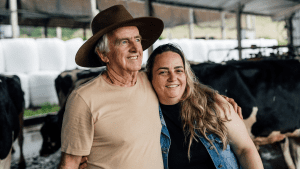

As we say here at Lifesolver Financial, having a second set of eyes look over your plan is never a bad idea – they might pick up on something important you’ve missed or an opportunity you didn’t see. Want us to take a look? Contact the team at Lifesolver Financial. Leveraging over 30 years of experience working with farmers, our team can help you with everything you need to achieve farm business success and a bigger future. Call us on (02) 5750 0519 or reach out to Matt: Info@lifesolver.com.au

*This blog/article is general and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. If relevant: Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement.